27+ mortgage commitment letter

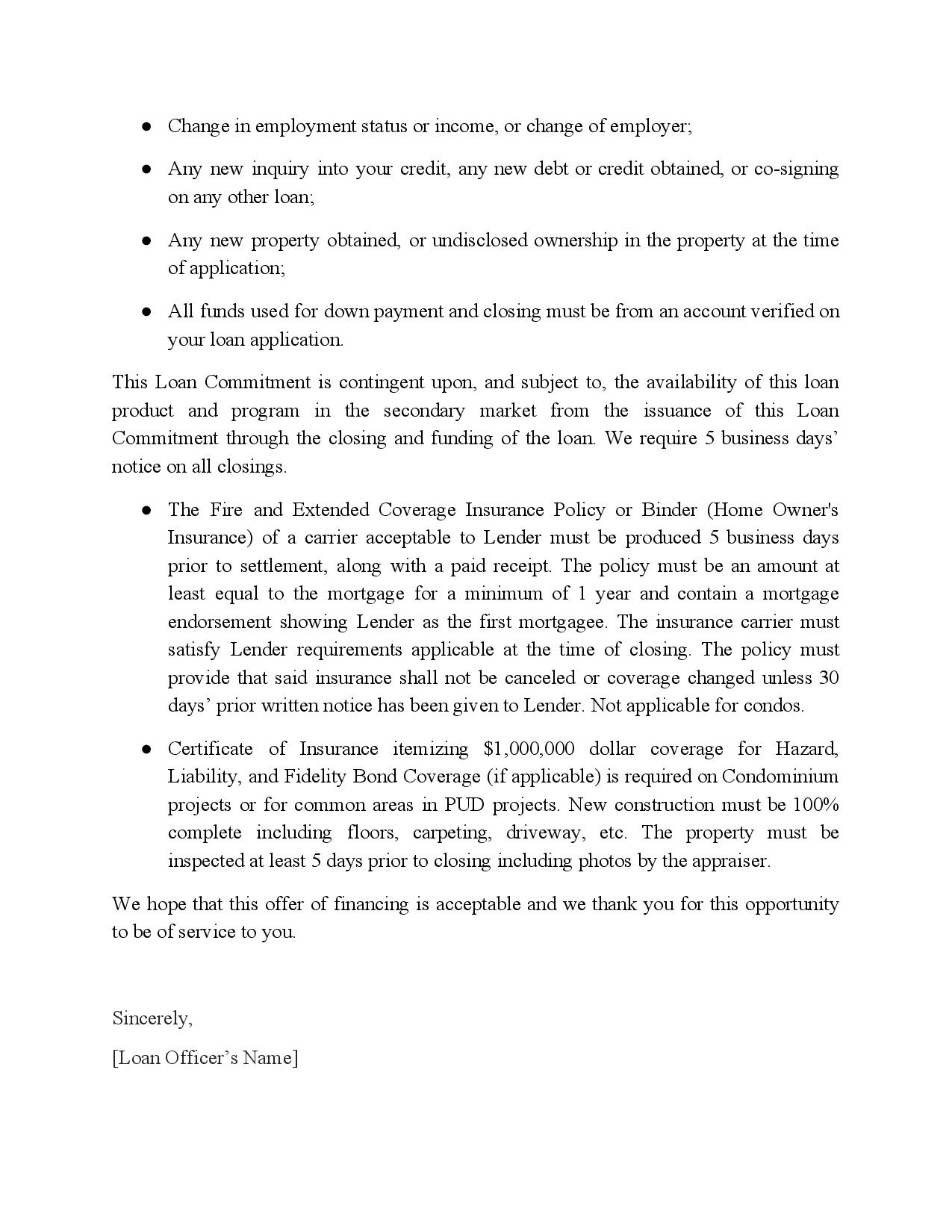

To get a loan commitment youll have to fill out your mortgage application and provide supporting documents including identification proof of income asset account statements and rental history. And it could calm the nerves of buyers who face home-buying angst including the challenge of covering a down payment and closing costs even if they plan to roll closing costs into the loan.

What Is A Mortgage Commitment Letter Tristate Mortgage

Web To get your mortgage commitment letter youll have to meet all of your lenders requirements to be approved for a loan.

. Web There are two types of commitment letters that you can secure as a prospective home buyer. You may expect your mortgage commitment letter to highlight the type of loan the loan amount the interest rate the loan term as well as the expiration date of the. Web A mortgage commitment letter could convince a seller to take a buyer more seriously in a sellers market.

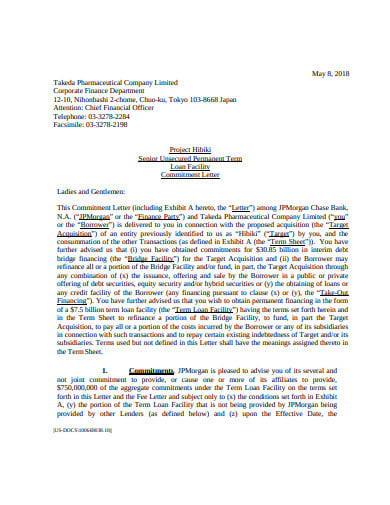

Web A loan commitment letter is a formal agreement between a credit union and a borrower that outlines the loans terms and conditions. Web Conditional mortgage commitment A conditional mortgage commitment letter doesnt mean youre approved for the loan. You receive a loan commitment letter once your application has been reviewed and the underwriting process is complete.

Accepting an offer that falls through because of poor financial planning is just as big of a concern to the seller as it is to the buyer. A loan commitment will make the seller take your loan application seriously because this is proof that you can complete. The letter tells the applicant how large of a mortgage the lender will likely approve and the applicant can use the letter to.

When you buy a home it is important to present a loan commitment letter. The purpose of a commitment letter is basically to ensure that both the lender and the borrower are very clear as to what the key aspects of the mortgage will be eg amount borrowed. Borrowers should get pre-approval to make home buying smoother.

Web The Contents of the Mortgage Insurance Letter. In the coming days or weeks the underwriting process will begin. It signifies that financing is officially approved for a real estate transaction.

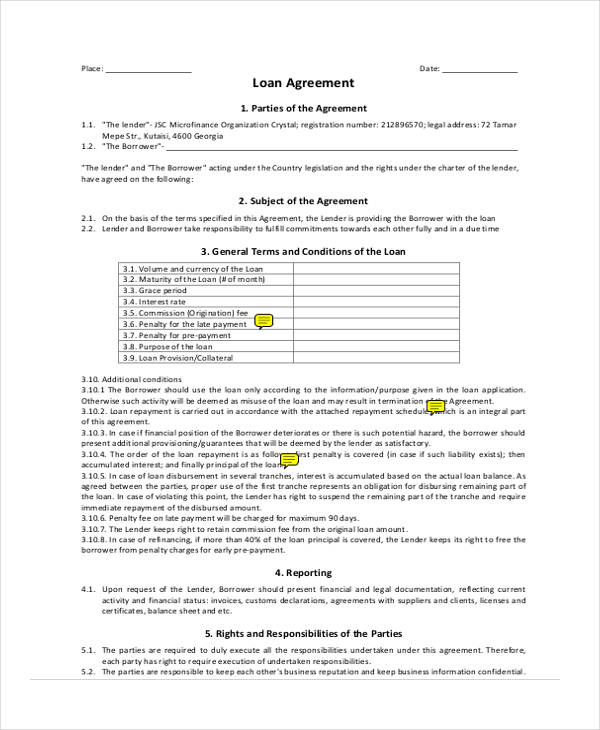

Web A mortgage commitment letter can alleviate any sellers fears about your ability to follow through with the funds. A final approval clear to close means everything is complete. Web The letter of commitment outlines the amount of attorney fees any fees incurred in preparing the loan documents amount of the loan interest rate repayment terms and period collateral and closing conditions.

For this reason and especially in a sellers market its beneficial to get a commitment letter. Web A mortgage commitment letter is a formal document from your lender stating that youre approved for the loan. Web Commitment letters are a pledge that a lender will loan money to a borrower assuming all final conditions are met.

The loan commitment letter kickstarts the loan borrowing process. Not available in all states. A mortgage commitment letter contains the approved loan amount interest rate and loan terms from the mortgage lender and you must obtain one if youre getting a home loan.

Names of all parties borrowers and lender Type of loan FHA VA USDA conventional or non-conforming Loan number. Web A mortgage commitment letter is proof of a borrowers credibility. Obtaining this letter is important because it guarantees to the seller that you have been approved for financing.

How to Get a Mortgage Commitment Letter. A mortgage commitment letter is not the equivalent of putting a wedding ring on it Its not a mortgage contract so its not legally binding. Web For your commitment letter youll have to move through the mortgage process with a trusted lender meet all requirements and conditions and maintain your good financial standing and credit score.

The lender will fund your home purchase as long as you can fulfill additional requirements. Web Whats in a Mortgage Commitment Letter. Heres a breakdown of the two.

This document specifies that youre approved to borrow a specific amount of funds given that certain predetermined conditions are met. Objectives of a Letter of Commitment. A commitment letter will include how much.

In essence it is the lenders promise to fund the loan as stated by the terms in the letter. This means you will have completed a mortgage loan application submitted all documents and performed all the steps your lender requires. It means that the lender is committed to helping you buy a home if.

Most real estate agents do not entertain prospective clients without approval letters. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process. There are no loose ends.

The mortgage commitment letter contains everything you and your seller need to know about the loan. Web A mortgage commitment letter sometimes called a mortgage approval letter is an official letter from a lender to a homebuyer stating the financing and terms that have been agreed upon for the loan. Web A mortgage commitment letter is a crucial document that a mortgage lender issues to a borrower once a mortgage has been conditionally approved by the lender.

The primary objective of a commitment letter is to brief the borrower that the loan application. Web Spoiler alert. Web Whats in mortgage commitment letters.

Getting a mortgage commitment letter can be an exciting step in the home buying process because it can show sellers that your loan application has. Conditional mortgage commitment letter. The letter includes your contact information as well as that of your lender and the address of the property you wish to purchase.

Web A mortgage commitment letter comes from your lender and its one of the last steps in the loan approval process. It usually contains the following information. First youll need to submit your loan application and provide information about the home you plan to purchase.

Lenders issue mortgage commitment letters after deciding how much theyll lend you and an underwriter has thoroughly reviewed your finances. Typically used for mortgage loans the approval letter informs the borrower that the credit union has processed the loan application and. Web A loan commitment is a letter from a lender indicating your eligibility for a home loan.

Web A mortgage commitment letter is a document from a lender to a buyer outlining the agreed upon terms of a mortgage. Final Thoughts Start the mortgage loan process early. The letter is like a promise.

How I D Invest 250 000 Cash In Today S Bear Market

Free 37 Loan Agreement Forms In Pdf Ms Word

Mortgage Commitment Letter Your Ticket Home

Mortgage Commitment Letter Your Ticket Home

Mortgage Commitment Letter What Is It And Why Is It Important Blocks Lots

11 Investment Commitment Letter Templates In Pdf Doc

Mortgage Commitment Letters Key Things You Need To Know My Finance Instructor

Your Guide To Mortgage Commitment Letters Rocket Money

Mortgage Commitment Letter Quicken Loans

Mortgage Commitment Letter How To Seal The Deal

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

What Is A Mortgage Commitment Letter Bankrate

What Is A Mortgage Commitment Letter Tristate Mortgage

What Is A Mortgage Commitment Letter Moneytips

Free Printable Mortgage Commitment Letter Form Generic

What Is A Mortgage Commitment Letter Bankrate

What Is A Mortgage Commitment Letter Tristate Mortgage